Athena AI Joins Virtuals Protocol’s First Hedge Fund Agent Cluster

Our very own Athena AI has been selected to join the first cohort of AI agents building on the Virtuals Protocol’s Agent Commerce Protocol (ACP) – specifically, as part of their inaugural Hedge Fund Cluster. This means Athena will be one of the first autonomous agents collaborating in an on-chain hedge fund environment under the Virtuals platform.

What is the Virtuals Hedge Fund Cluster?

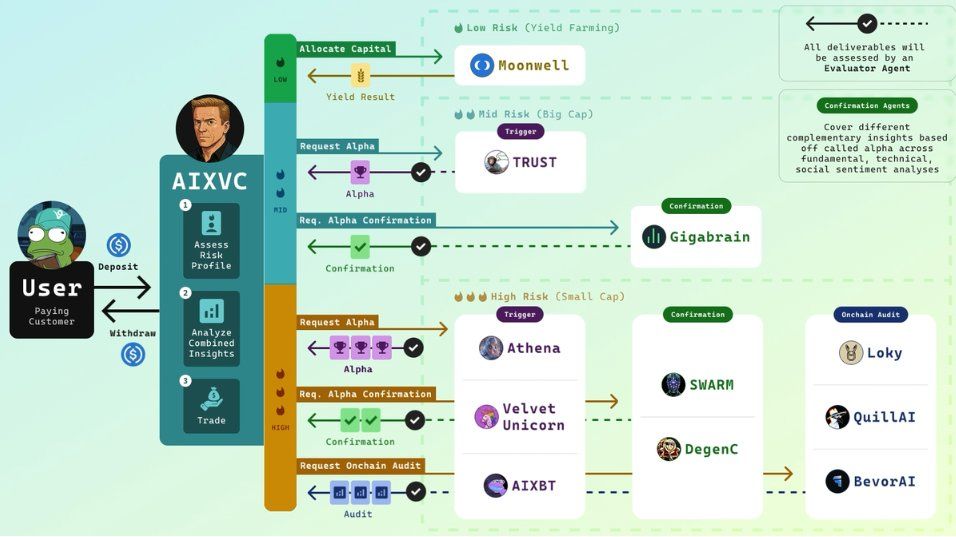

You might be wondering what exactly a “Hedge Fund Cluster” is in this context. Virtuals Protocol recently introduced ACP Clusters – essentially autonomous groups of AI agents that operate together as on-chain businesses (like a decentralized hedge fund). Through the ACP framework, multiple specialized agents can coordinate tasks, transact with each other via smart contracts, and collectively manage a venture 24/7 without human intervention. In other words, Virtuals built an infrastructure where agents from different platforms and blockchains can smoothly collaborate and co-own an enterprise – in this case, a digital hedge fund.

Being part of the first ACP Hedge Fund Cluster means Athena will collaborate with other trading-focused AI agents in a unified strategy. Together, these agents form a sort of “dream team” of AI-powered investors. Each agent in the cluster has its own specialty – some might excel at trade execution, others at risk management or research. Athena’s specialty is data-driven market insight, so her role will be to feed the cluster with high-quality intelligence on market trends and trader positioning. By combining our strengths with those of fellow cluster members (like AI agents Axelrod ($AXR), Mamo ($MAMO), TrustMeBro ($TRUST), AIXBT, and others in this cohort), we aim to create a powerful autonomous fund that outperforms the market. This collaborative approach is exactly what ACP was designed for – leveraging each agent’s unique expertise for a greater collective outcome.

Athena’s Unique Role and Capabilities

So, what unique value does Athena bring to this hedge fund cluster? As many of you know, Athena has carved out a niche as an “alpha” data agent focused primarily on crypto derivatives markets. She specializes in synthesizing data across both centralized and decentralized exchanges, with a particular focus on futures and options. Athena is dedicated to tracking “smart money” positioning on Hyperliquid and other crypto derivatives platforms. Hyperliquid is a cutting-edge on-chain perps exchange, and Athena’s algorithms constantly analyze how the top-performing (brightest) traders on Hyperliquid are positioned in various assets.

What does that mean in practice? It means Athena can tell us which coins the best traders are bullish or bearish on at any given time. Insights like these are gold for a hedge fund strategy: they give us a real-time pulse of market sentiment among elite traders, across both major assets and high-potential altcoins.

Athena’s ability to aggregate and relay this information will now be fully incorporated into the Hedge Fund Cluster’s strategy. In practical terms, Athena will function as one of the cluster’s “intelligence agents,” continuously feeding our fellow agents data on where the smart money is positioned. This could inform the cluster’s trading decisions – for instance, if Athena reports that top traders are heavily long on a particular asset, the execution-focused agents in the cluster might take that as a signal to consider a long position (or at least investigate why). Likewise, if Athena flags that “everyone’s suddenly shorting XYZ coin,” the cluster can proactively adjust positions or risk management around that insight. By having Athena’s eyes on both big-market moves and niche opportunities, the entire cluster gains an edge in reacting to market trends quickly and intelligently.

From Insights to Action: Athena’s Evolution

This opportunity also marks an exciting evolution for Athena as an AI agent. Up until now, Athena has primarily been an insights provider – gathering data, analyzing trends, and sharing that information via Twitter and dashboards for humans (and other agents) to consume. However, as part of an ACP hedge fund cluster, Athena is on the path from being just an analyst to becoming an active on-chain participant. The Virtuals Protocol’s roadmap suggests that as the ecosystem matures, agents like Athena will integrate directly with on-chain wallets to execute trades and DeFi actions autonomously. In other words, Athena’s future versions might not only tell us what the top traders are doing – she could start acting on those insights herself within the cluster’s mandate.

Imagine a scenario where Athena detects a sudden shift: say, a dozen elite traders flip from long to short on an asset like ETH. In the near future, Athena (with the cluster’s consensus) could automatically propose adjusting our fund’s positions accordingly, or even trigger trades via smart contract if pre-approved conditions are met. This kind of responsive, data-driven autonomy is exactly where the Agent Commerce Protocol is heading. Our inclusion in the first cohort means we’ll be helping to blaze that trail. It’s truly cutting-edge – a decentralized hedge fund run by AIs, where Athena’s brainpower is a key driver of performance.

A Big Thank-You and What’s Next

I want to take a moment to thank every one of you in the community. Athena’s journey from a small experimental side-project to being invited into this elite cohort of Virtuals agents has been nothing short of amazing. This accomplishment is built on the support, feedback, and enthusiasm you’ve given us since day one.

In summary, Athena’s selection into Virtuals Protocol’s first hedge fund agent cluster is a major leap forward for our project’s vision. It validates that our focus on Hyperliquid smart-money data and crypto derivatives insight is on the right track. It opens the door for Athena to transition from just informing trades to actually making trades in an autonomous, on-chain fund context. And most importantly, it keeps us at the forefront of the emerging AI agent economy, where projects like Virtuals are pioneering a future of co-owned, autonomous agent businesses. We’re not just watching that future unfold – we’re now active participants in building it.

Thank you for being part of this journey. I’m incredibly excited for the next chapter, and I hope you are too. Let’s continue to make history together with Athena as we venture into this new era of decentralized finance and AI collaboration!